tax per mile san diego

Believe CARBs response is a major development as SANDAG must now. The San Diego Association of Governments board will meet virtually Friday to discuss a four cent-per-mile tax proposal which could impact every driver in San Diego County.

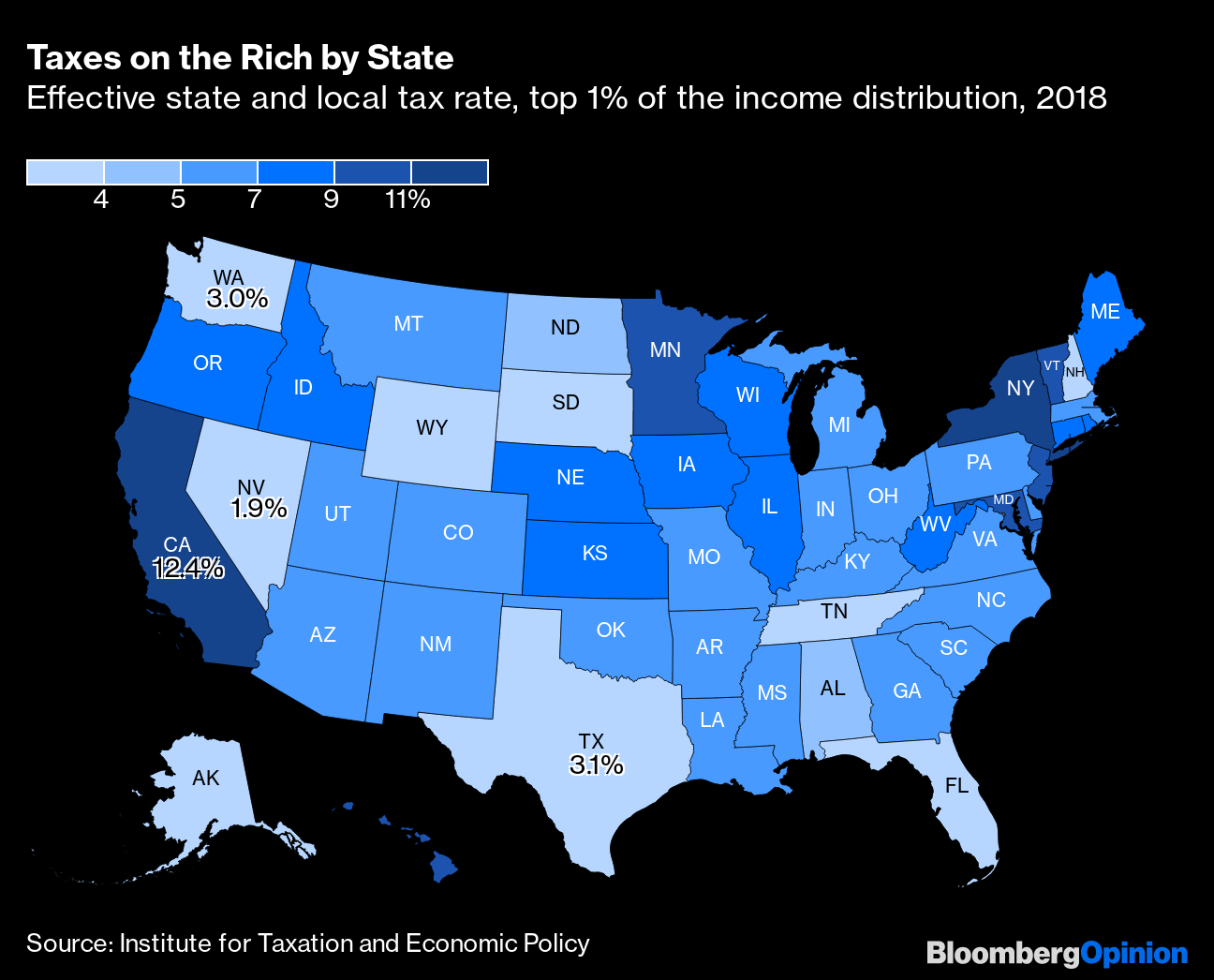

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

Oregon lawmakers are considering a bill that would require owners of new fuel-efficient cars and trucks pay a fee for every mile they drive beginning in 2026.

. Avalara can simplify fuel energy and motor tax rate calculation in multiple states. Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance. The proposed tax is part of a 163 billion plan to improve transportation in San Diego County.

The San Diego Association of Governments. SANDAGs latest plan was to change the current gas tax that San Diego residents already pay. Among other things SANDAG hopes to make public transit free for everyone.

A proposed per-mile tax by San Diego lawmakers for a road charge threatens privacy rights some county officials say. It claims this will. The board is expected to vote on the proposal Dec.

Two half-cent regional sales taxes for 2022 and 2028. Avalara can simplify fuel energy and motor tax rate calculation in multiple states. The four-cent-per-mile tax -- and two half-cent regional sales taxes scheduled for 2022 and 2028 -- is envisioned as a way to help fund SANDAGs long-term regional plan an.

The proposed tax is part of a 163 billion plan to improve transportation in San Diego County. San Diego proposes a milage tax to fund a 160 billion regional plan to increase public transit usage from 34 percent to 13 percent over the next 30 years. A massive transportation plan being ironed out by the San Diego.

The four-cent-per-mile tax -- and two half-cent regional sales taxes scheduled for 2022 and 2028 -- is envisioned as a way to help fund SANDAGs long-term regional plan an. The policy would introduce a 2- to 6-cent tax on drivers per mile on local roads to help pay for the improvements. Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

SANDAG is still looking into how it would track a drivers miles. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that includes building out. S AN DIEGO COUNTY CA The San Diego Association of Governments board will meet virtually Friday to discuss a four cent-per-mile tax proposal which could impact every driver in San.

In San Diego the concern is less on road costs and more on how to fund a 30-year 160 billion regional plan that would include things such as free public transportation and. SAN DIEGO KUSI In December 2021 SANDAG passed its regional transportation plan. A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on.

NBC 7s Artie Ojeda heard reaction from San Diegans and elected officials about the proposed per-mile tax. A per-mile road usage tax.

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Understanding California S Property Taxes

California Used Car Sales Tax Fees 2020 Everquote

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

Highest Gas Tax In The U S By State 2022 Statista

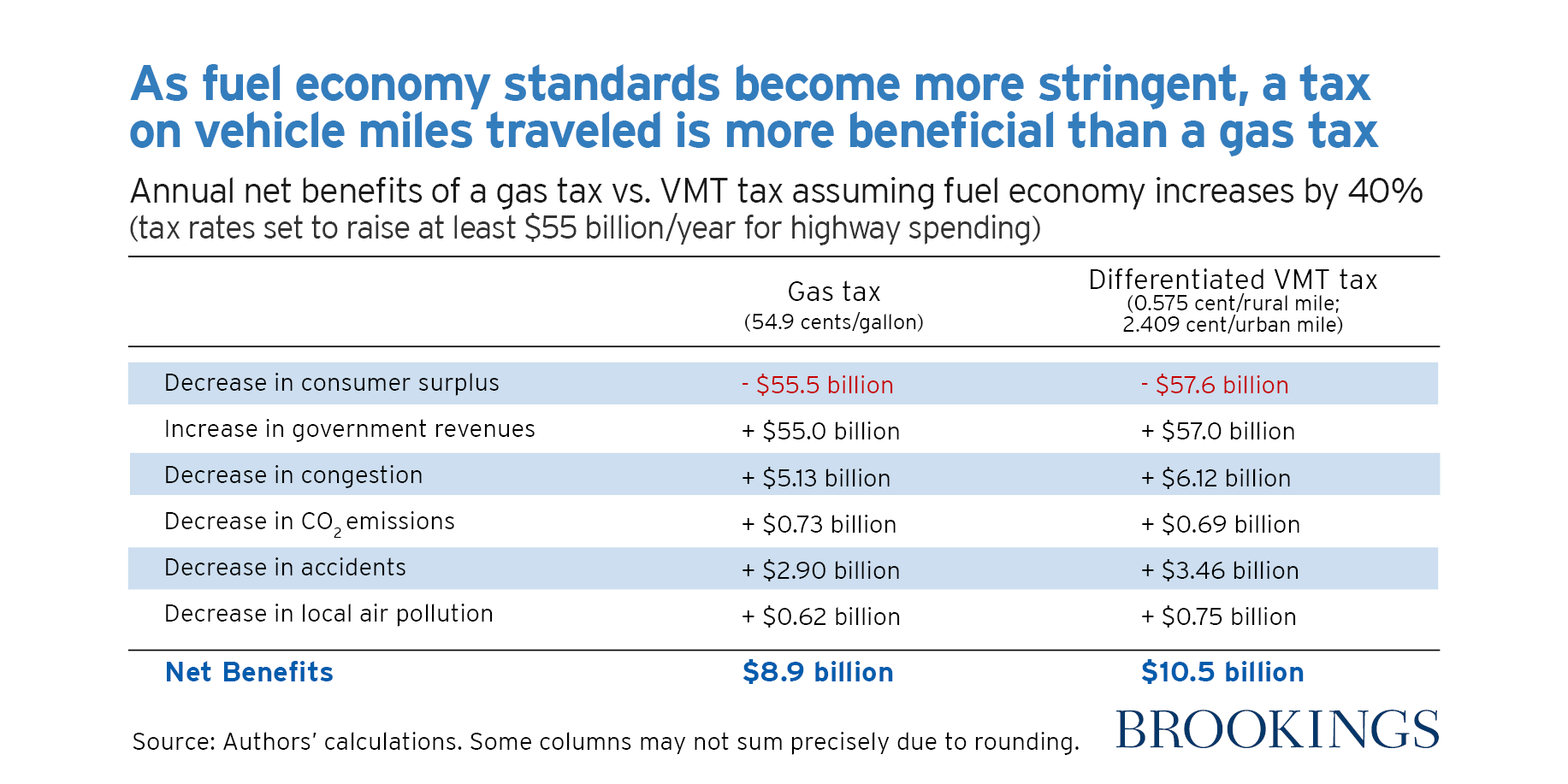

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

Gorgeous Rolls Royce Wraith Lease Special Call Today At Cars For Sale Royce Lease

Understanding California S Property Taxes

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Home Share Taxes Driving You Crazy Don T Worry Our Super Simple Airbnb Tax Guide Will Answer All Of Your Questions In Tax Guide Online Taxes Sharing Economy

From The Archives San Diego Gobbled Up Swath Of South County 65 Years Ago

California Repeal Gas Tax And Fees Increase Bill Initiative 2018 Ballotpedia

Why You Should And Can Benchmark Profitability How Moving Beyond Revpar Can Improve Your Botto Positive Cash Flow Key Performance Indicators Hotel Operations

1200 Week Rental Rates For Premium Passenger Sprinter Vans Rates Include Applicable Taxes And Fees Daily 190 00 225 00 Sprinter Van Mercedes Van Van

Truck Driver Contract Agreement Free Printable Documents Contract Agreement Truck Driver Letter Sample

1954 Austin Healey 100 Austin Healey Austin Cars Austin

Sales And Use Tax Regulations Article 11

Ca Proposition 6 A Measure To Repeal Last Year S Increase To The State Gas Tax Could Be One Of The Most Consequential Issues On The November Gas Tax Tax Gas